Why Are Types of Business Research So Critical for Success?

Did you know that companies that base their decisions on solid research are 2.5x more likely to have higher revenue growth? Here’s what you really need to know before we dive deeper into specific methods.

Think of business research like a toolkit – each method serves a unique purpose. Primary research is your custom-built solution, giving you fresh, specific insights but requiring more resources. Secondary research, on the other hand, leverages existing data, offering quick insights at a fraction of the cost. Qualitative methods tell you the “why” behind decisions, while quantitative methods give you the “how many” and “how often.”

From my experience, successful companies don’t just pick one approach – they strategically combine methods based on their goals. For instance, starting with secondary research to understand market size, following up with surveys for quantitative validation, and then using focus groups to deep dive into customer motivations.

The key is matching your research method to your business question. Looking to understand market trends? Secondary research might be your best bet. Need to know why customers choose your competitors? Qualitative research could hold the answer. Want to test pricing strategies? Quantitative methods will give you the hard data you need.

In the following sections, we’ll explore each research method in detail, looking at when to use them, how to implement them effectively, and most importantly – how to avoid the costly mistakes I’ve seen companies make along the way. Let’s start by diving into our first method…

For more details on conducting business research, check out my comprehensive guide “How to Do Business Research: A Step-by-Step Guide (2025)“

Which is Better: Primary or Secondary Business Research? Exploring Types of Business Research

Let me tell you something that still makes me chuckle – my first attempt at market research for my agency about 4 years ago. I was so convinced that we needed to conduct an extensive primary research study that I spent weeks designing surveys . Meanwhile, there was a goldmine of industry reports sitting right there that could have answered half our questions in a fraction of the time.

That expensive lesson taught me something crucial about business research: it’s not about choosing between primary and secondary research – it’s about knowing when to use each one. Let me break this down for you with everything I’ve learned since that costly mistake.

First, let’s get crystal clear on what we’re talking about. Primary research is when you’re out there collecting fresh data yourself – think surveys, interviews, focus groups, or field observations. Secondary research involves analyzing existing data, like industry reports, government statistics, or academic studies. Both have their sweet spots, and I’ve learned (sometimes the hard way) when to use each.

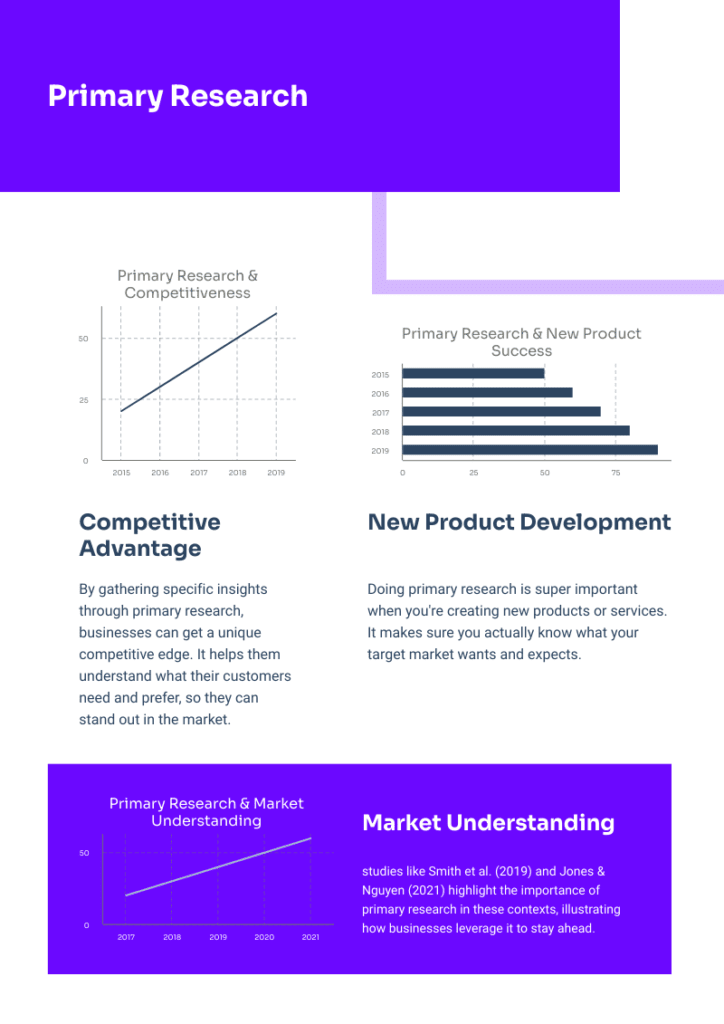

The real magic of primary research is that you get exactly what you’re looking for. When I needed to understand why customers were abandoning their shopping carts on an e-commerce site, no amount of existing research could tell me what our specific users were thinking.

But here’s where secondary research shines – it’s typically faster and more cost-effective. Last year, I helped a startup that wanted to understand the overall market size for their new app. Instead of spending months surveying potential users, we dug into existing market reports and census data. Within a week, we had a solid understanding of the market landscape at a fraction of the cost.

Let me share some practical guidelines I’ve developed over the years for choosing between primary and secondary research:

Use primary research when:

- You need specific insights about your unique customers or product

- Your market is new or rapidly changing

- You’re testing a specific hypothesis about your business

- You need to understand the ‘why’ behind customer behavior

Go with secondary research when:

- You need broad market insights or trends

- You’re in the early stages of business planning

- You’re dealing with time or budget constraints

- You need historical data or trend analysis

The costs can vary wildly, and I’ve seen both extremes. A comprehensive primary research study with focus groups and surveys might set you back $10,000-50,000, while good secondary research might only cost you a few hundred dollars in subscription fees to research databases. But don’t let those numbers fool you – sometimes that expensive primary research is worth every penny when it prevents a major business mistake.

One approach that’s worked really well for me is starting with secondary research to get the lay of the land, then using primary research to fill in the specific gaps. For instance, imagine a scenario where you are assisting a client in launching a new type of eco-friendly beverage. Initially, secondary research might be used to understand the size of the market and general trends in consumer preferences for sustainable products. Subsequently, primary research could be conducted through taste tests and surveys to refine the beverage’s formula and packaging for the specific target audience.

The biggest mistake I see people make? Treating research like an either/or decision. These days, I almost always recommend a hybrid approach. Start broad with secondary research to understand the bigger picture, then zoom in with primary research to answer your specific questions.

Let me tell you – nothing beats the feeling of presenting research findings that actually drive business decisions. Whether you’re pulling data from existing sources or gathering it yourself, the key is matching your research method to your specific needs and resources.

Remember, perfect is the enemy of good when it comes to research. Sometimes, a quick dive into existing data is all you need. Other times, you’ll need to roll up your sleeves and gather that data yourself. The trick is knowing the difference – and that comes with experience (and yes, sometimes learning things the hard way).

How Do You Conduct Effective Qualitative Research in Business?

You know what’s kind of funny? After spending all that time figuring out whether to use primary or secondary research (like we just talked about), I discovered that qualitative research has its own special kind of magic. But here’s the thing – it took me years to really get the hang of it.

Let me walk you through some real-world examples from my experience with different qualitative methods that go beyond just the basics we covered earlier. Trust me, there’s an art to this that most textbooks don’t tell you about.

Remember how I mentioned those user interviews earlier? Well, there’s actually a whole psychology to conducting them effectively. I learned this lesson during a project where I was interviewing executives about their decision-making processes. I’d prepared all these structured questions, but the real insights came when I just shut up and listened. One CEO went off on what seemed like a tangent about his morning coffee routine, which ended up revealing crucial information about how he processes information and makes decisions early in the day.

Focus groups are another beast entirely. Here’s something nobody tells you – group dynamics can completely make or break your research. It’s these little techniques that make the difference between useful insights and just a bunch of people chatting.

Observational research might sound simple – just watch and take notes, right? Wrong. I learned this the hard way while doing retail floor observations. Initially, I was so focused on writing down every little thing that I missed the patterns. Now I use a technique – where I literally draw lines on a store layout showing how people move and cluster. This has revealed incredible insights about store layout and product placement that traditional observation methods missed.

When it comes to case studies, most people make the mistake of trying to document everything. But through trial and error, I’ve found that the key is focusing on decision points. Any time someone in your case study had to make a choice, that’s where the gold is. I now structure all my case studies around these critical moments rather than trying to tell the whole story chronologically.

Just remember – the goal isn’t academic perfection. It’s about gathering rich, meaningful insights that actually help solve real business problems. And sometimes, the messiest, most unexpected research moments lead to the biggest breakthroughs.

What’s the difference between primary and secondary research, and which is more cost-effective?

Primary research involves collecting new data directly from sources (like surveys or interviews), while secondary research uses existing data. Secondary research is typically more cost-effective and faster, often 60-70% cheaper than primary research. However, primary research provides customized insights specific to your business needs. For most projects, I recommend starting with secondary research and then filling gaps with primary research as needed.

How do I know when to use qualitative vs. quantitative research?

Use qualitative research (like interviews and focus groups) when you need to understand the “why” behind behaviors or decisions – it’s perfect for exploring customer motivations and experiences. Use quantitative research (like surveys and data analysis) when you need numerical data to validate theories or measure specific metrics. Ideally, use both: qualitative research to develop hypotheses and quantitative research to validate them across a larger sample.

How do you present research findings effectively to stakeholders?

Focus on actionable insights rather than raw data. Start with key findings and recommendations, support them with data, and always tie insights back to business objectives. Use visualizations for complex data and include specific, actionable next steps. Remember the “So what? Now what?” framework – explain why findings matter and what should be done about them.