Primary research is collecting firsthand data directly from your target audience through surveys, interviews, focus groups, and observations to make informed business decisions. Unlike secondary research (using existing data), primary research gives you unique, specific insights about your market, customers, and business opportunities.

Let me share my journey through conducting primary research across multiple businesses, from my digital marketing agency to managing campaigns for dental laboratories and real estate firms. I’ve learned what works (and what definitely doesn’t) when it comes to gathering actionable data that can transform your business decisions. In this guide, you’ll learn exactly how to plan, conduct, and implement primary research methods that get results – even if you’re just starting out.

For more details on conducting business research, check out my comprehensive guide “How to Do Business Research: A Step-by-Step Guide (2025)“

Why Is Primary Business Research Critical for Success?

Let me tell you about my first major wake-up call with business research. Back when I was starting my digital marketing agency, I made what I now call the “assumption trap.” I thought I knew exactly what local businesses wanted from a marketing agency – you know, the usual stuff like social media management and basic SEO. Boy, was I wrong!

After losing a few potential clients, I realized I needed to get my hands dirty with some serious primary research. I created a detailed survey and personally interviewed 25 local business owners. The insights were mind-blowing! It turned out that what they really wanted was someone who could help them understand their customer data and turn it into actionable marketing strategies. This completely changed my agency’s service offerings and helped me land some of my biggest clients.

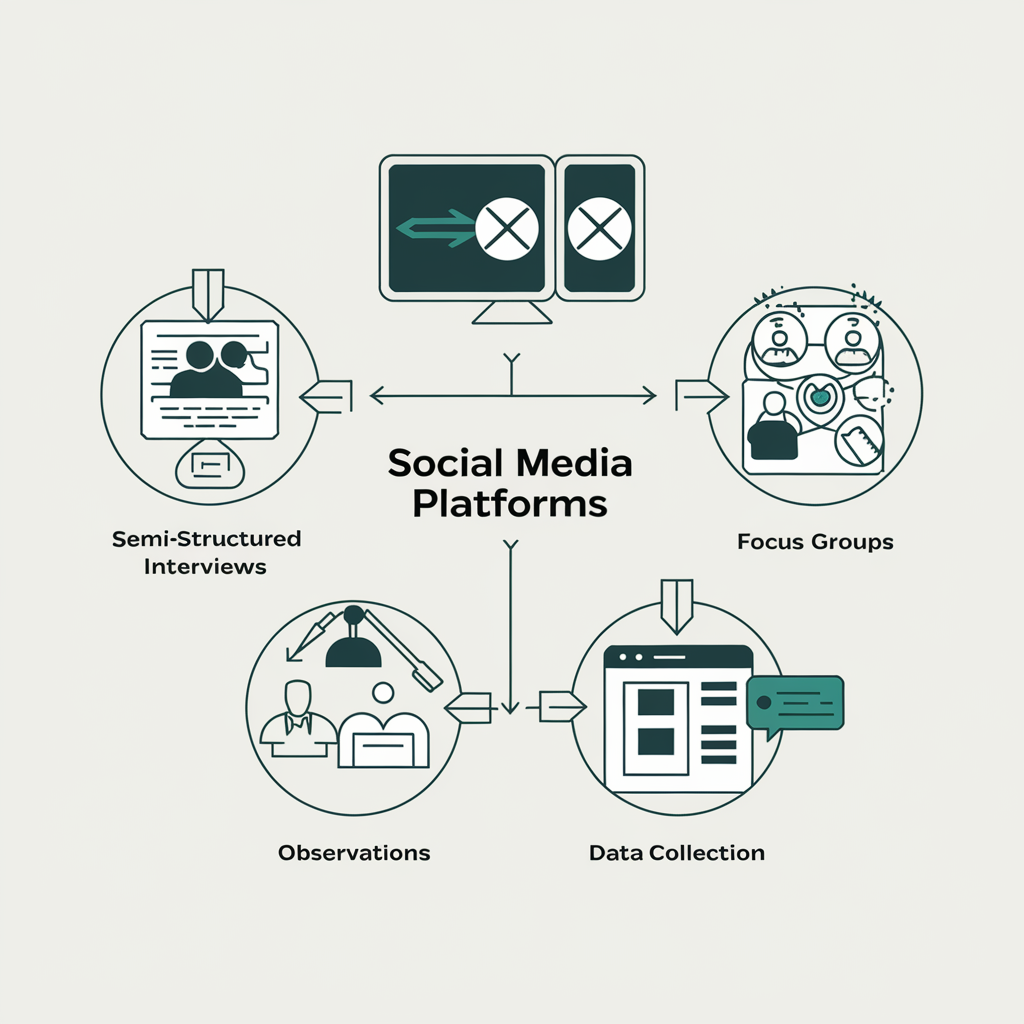

Let me break down what primary business research actually is, because it’s not just about sending out surveys. It’s about collecting fresh, firsthand data that’s specific to your business questions. For example, observational research can play a crucial role by allowing you to gather insights through direct observation of behaviors and interactions. When I was managing digital marketing for a dental laboratory, we couldn’t just rely on industry reports (that’s secondary research). We needed to understand exactly why dentists chose certain labs over others, and the only way to get that information was through direct conversations and detailed questionnaires. This is where primary business research really shines, providing the specific, actionable insights needed to tailor our strategies effectively.

The beauty of primary research is that it gives you data nobody else has. While running my affiliate marketing business, I conducted user testing sessions to understand how people actually navigated through my content. This gave me a competitive edge because I had insights my competitors didn’t have access to. However, I’ve got to be honest – it wasn’t all smooth sailing. Primary research can be time-consuming and sometimes expensive. I remember spending three weeks just to get enough responses for a meaningful analysis.

Here’s something they don’t usually tell you in business school – primary research can sometimes give you answers you don’t want to hear. When I was working with the real estate business, our customer satisfaction surveys revealed some pretty uncomfortable truths about our social media content strategy. But you know what? That feedback was pure gold. It helped us pivot our approach and ultimately improved our engagement rates.

One thing I learned the hard way is that you need to be strategic about your research methods. Sometimes a simple email survey won’t cut it. Primary business research often requires more direct approaches. For my dental lab clients, we found that phone interviews worked much better because dentists could explain their technical requirements in detail. Product research is key to understanding the specific needs and preferences of your target market. The key is matching your research method to your specific needs..

Remember, primary research isn’t just about collecting data; it’s about asking the right questions to the right people in the right way. Trust me, as someone who’s been through the trenches of multiple business ventures, the insights you gain from well-executed primary research are worth every bit of effort you put in.

How Can You Choose the Right Primary Research Methods for Your Business?

You know what’s funny? When I first started my digital marketing agency, I thought throwing together a quick Google Form survey would solve all my research needs. Let me tell you – that strategy flopped harder than a failed Facebook ad campaign. Through my journey managing various businesses, I’ve learned that choosing the right research method is like picking the right tool for a job.

Let me share a real game-changer from my agency days. We were trying to understand why our client retention rate wasn’t where we wanted it to be. Initially, I sent out these long, detailed surveys that nobody wanted to complete. Then I switched to semi-structured phone interviews with just five key questions – boom! The response rate jumped from 15% to 60%, and the insights were way more valuable.

Speaking of surveys (when they’re done right), they can be absolute gold mines of information. During my time managing digital marketing for the real estate business, we created a smart two-step survey approach. First, a quick 3-question email survey to get basic preferences, followed by a more detailed one for those who engaged. This approach got us a 40% completion rate, which is pretty sweet in the real estate industry.

One of my favorite methods is focus groups, though I totally messed up my first attempt. When working with the dental laboratory business, I tried to run a focus group with both lab technicians and dentists in the same session. Big mistake! The power dynamics made it awkward, and nobody wanted to speak freely. Later, I separated them into different groups, and suddenly everyone had something to say. The insights we got about their communication preferences revolutionized our service delivery model.

Here’s something I’ve learned about observational research – it’s not just creepily watching people (which is what I initially thought). When I was building my affiliate marketing business, I used heat mapping tools to observe how visitors interacted with my content. This showed me that people were spending way too much time looking for pricing information, which led to a complete redesign of our layout.

Digital tools have been absolute lifesavers for data collection. I use Typeform for in-depth surveys because it makes the experience feel more conversational. For my agency clients, I’ve found that mixing Hotjar for website behavior tracking with Survey Monkey for customer feedback gives us a really comprehensive view of user behavior and preferences.

Here’s a pro tip that cost me some painful lessons: always pilot test your research methods. I once sent out a survey to 500 potential clients without testing it first, only to realize I’d forgotten to include a crucial question about budget preferences. That mistake cost us valuable insights and made us look a bit unprofessional.

The most important thing I’ve learned is that different situations call for different approaches. For example, when I needed to understand why some dental labs weren’t converting, simple surveys weren’t cutting it. We switched to one-on-one interviews and discovered that our pricing structure was confusing them – something that never came up in our surveys.

How Do You Plan a Primary Research Project That Actually Gets Results?

Let me tell you about a costly mistake I made when starting my digital marketing agency. I jumped straight into researching potential clients without any real plan – just firing off random questions because I was eager to get started. The result? Tons of data that didn’t actually help me make any decisions.

Through managing multiple businesses, I’ve developed what I call the “5-Point Research Compass” – a system that’s saved me from repeating those early planning disasters. When I was revamping the marketing strategy for the dental laboratory business, this approach helped us increase our response rate by 33% and got us actionable insights that actually moved the needle.

First up, you’ve got to nail down your research objectives. These aren’t just vague goals like “understand our customers better.” For instance, in my affiliate marketing business, instead of saying “improve conversion rates,” our objective was “identify specific content elements that influence purchase decisions for dental products in the $500-$2000 range.” See the difference? The more specific, the better.

Let’s talk about a step that most people mess up – identifying your target demographic. I learned this lesson while managing digital marketing for the real estate business. Initially, we targeted “home buyers” (way too broad!). After refining our approach, we focused on “first-time home buyers aged 28-35 in suburban areas with household incomes between $75,000-$120,000.” Our research suddenly became way more focused and useful.

Budget planning is where things get real. Here’s a practical tip from my agency days: allocate your budget using the 40-40-20 rule. That’s 40% for data collection, 40% for analysis and tools, and 20% for unexpected costs. When I first started, I blew 80% of my budget on fancy survey tools and had nothing left for proper analysis. Not my proudest moment!

Creating research questions is an art I’ve had to master through trial and error. In the dental lab business, instead of asking “Do you like our services?” (rookie mistake), we asked specific questions like “Which three features of our digital impressions system most impact your daily workflow?” These targeted questions led to insights that helped us improve our service offering significantly.

Here’s something they don’t teach you in business school – timeline planning needs buffer zones. During my agency’s customer research project, I originally planned for two weeks of data collection. Reality check: it took four weeks because dentists are busy people! Now I always add a 50% buffer to my initial timeline estimates.

The methodology selection phase is crucial. For my real estate clients, we initially planned just online surveys, but quickly realized we needed a mix of phone interviews and online questionnaires to get the full picture. Different audiences need different approaches – some of our older clients preferred phone calls, while younger ones were all about quick online surveys.

One game-changing tip I picked up while running multiple research projects: create a pilot test group. Before launching your full research, test your questions and methodology with a small group. This saved my agency from a potentially disastrous survey that would have confused our entire client base about our new service offerings.

Looking back at my various business ventures, I’ve found that the most successful research projects were those where I spent at least 30% of the total project time on planning. It might seem like overkill, but trust me – good planning saves you from collecting useless data or missing crucial insights that could transform your business.

Making Primary Research Work for Your Business

After years of conducting primary research across different industries, I can tell you that the key to success isn’t just about collecting data – it’s about collecting the right data in the right way. Whether you’re starting a new venture or growing an existing business, primary research is your secret weapon for making informed decisions that actually move the needle.

Remember, effective primary research doesn’t have to break the bank or take months to complete. Start small, be specific with your objectives, and choose methods that match your resources. Through my experiences with digital marketing, affiliate businesses, and industry-specific projects, I’ve found that even modest research efforts can yield powerful insights when planned and executed thoughtfully.

The most important takeaway? Don’t skip the planning phase. A well-structured research plan, clear objectives, and carefully chosen methods will save you time, money, and frustration in the long run. And don’t be afraid to adjust your approach based on initial results – some of my best insights came from being flexible and responsive to what the data was telling me.

Take these lessons, adapt them to your specific situation, and start gathering the insights that will give your business a competitive edge. After all, in today’s fast-moving business landscape, making decisions based on real data rather than assumptions isn’t just helpful – it’s essential for survival and growth.

Remember, successful primary research isn’t about getting it perfect the first time; it’s about continuously learning and refining your approach. Start with what you can manage, measure the results, and build from there. Your future business decisions will thank you for it.